Work with Government

Te Mahi Tahi me te Kāwanatanga

Work with Government

Te Mahi Tahi me te Kāwanatanga

Policy advice

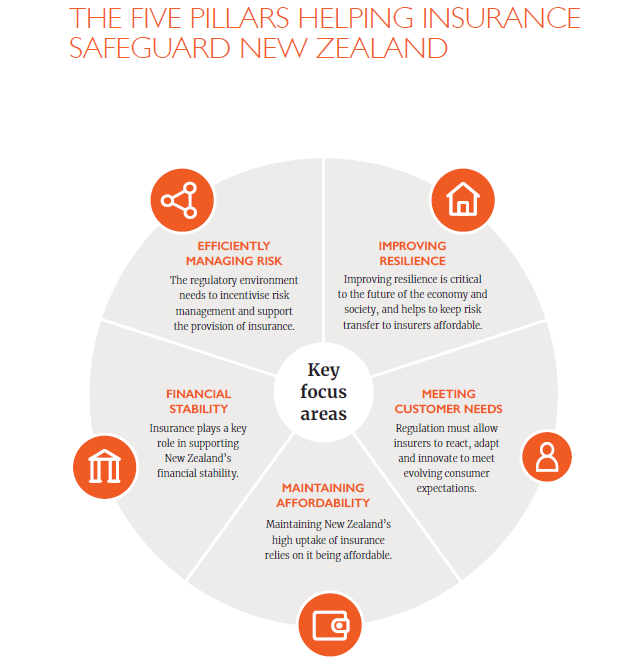

We’ve identified 25 policy actions to help insurance safeguard New Zealand. These are laid out across five key themes on a one-page infographic.

Information on these policy actions and further details can be found by downloading our support guide, Policies for a Responsive and Sustainable Insurance Sector to Safeguard New Zealand.

Fire & emergency services levy collection review

ICNZ is a strong advocate for reform to the way New Zealand’s fire and emergency services are funded. For over 40 years, fire services in New Zealand have been funded by a tax on New Zealanders’ insurance policies. That tax is outdated, unfair and inefficient. A levy on insurance is the worst possible option for funding Fire and Emergency New Zealand (FENZ) and finding supported by around 20 independent reports produced since 1993.

We see several reasons for this:

- FENZ’ response to fires and emergencies is a public good. Public goods should be publicly funded through general taxation.

- FENZ shows up to fires and emergencies regardless of whether the person or property involved is insured, so the historic link between property insurance and the Fire Services is tenuous.

- People who have to pay the levy on insurance and their advisers have historically structured their insurance arrangements to avoid levy, which adds costs to the regime and makes it more inefficient.

- General taxation is the best option for emergency service funding. It would be more cost effective as Government would be able to use existing tax collection systems – the Inland Revenue – instead of private insurers and FENZ having to pay extra to administer collection. It would be a more stable and predictable funding base than insurance. It would increase FENZ’ spending accountability and efficiency as it would be subject to scrutiny by The Treasury.

- Funding emergency services through a levy on insurance is out of line with other New Zealand agencies (like the Police) and international practice.

While ICNZ is disappointed with the Government’s recent decision to continue funding FENZ services through an insurance levy, will engage constructively to achieve a better way of applying the tax on insurance consumers.

Conduct reform

We support in concept the introduction of conduct legislation for financial services to ensure good conduct and fair treatment of customers is more widely achieved.

However, to ensure that such provisions are to the benefit of consumers (regardless of who they deal with for their insurance), it is critical that the Financial Markets (Conduct of Institutions) Amendment Bill and the regulations and other instruments developed under them, are comprehensive, proportionate, and carefully integrated with related regulatory frameworks, with clear accountability and consistent fair conduct obligations specifically sitting with all parties directly involved in developing/selling/distributing insurance across the value chain to the end consumers (including intermediaries). If not, there is a risk of inconsistency, poor consumer outcomes and the potential for regulatory arbitrage.

Insurance contracts law review

ICNZ has welcomed the progression of the review of insurance contract law that commenced in 2018. We support changes to the law for insurance contracts in response to issues that have been identified, where they support the sustainable and efficient provision of insurance in New Zealand and facilitate innovation. This includes rationalising and modernising the insurance law regime (which is currently fragmented across six pieces of separate legislation) and rules regarding the disclosure obligation, noting that under the Fair Insurance Code our members are already required to explain what disclosure means and act proportionally in the event this obligation is breached, as proposed.

We recognise the importance of having well informed customers and also support changes designed to make insurance policies easier to understand, noting again that this is something covered off already under the Fair Insurance Code.

Our overarching view is that the legal regime should aim to create the right environment for good customer outcomes, while supporting fair competition, continuous innovation and certainty, which is also to customers benefit. This requires a legislative regime for insurance contracts that gives insurers, and the reinsurers that support them, confidence and certainty to commit their risk capital to the New Zealand insurance market.

In addition to the issues highlighted in the review so far, the review should also take into account outstanding matters that are foundational to the provision of insurance in New Zealand, including unlicensed insurance activity and aspects of the relationship between insurers and intermediaries that need to be modernised. Failing to address these issues would be major missed opportunity.

Prudential supervision review

It is positive that the review of IPSA, which commenced in 2017 and was then put on hold in 2018 and then sensibly deferred to later in 2020 due to COVID-19, has now recommenced and is progressing. There is a need for greater transparency and accountability for regulatory decisions under the IPSA, with a stronger focus on competitive neutrality and minimising compliance costs and merit reviews of key decision. The use of the term insurer by unlicensed insurers must also be prohibited.

Most insurance activity in New Zealand is undertaken by insurers that are licensed by the Reserve Bank under the Insurance (Prudential Supervision) Act 2010 (IPSA). Nonetheless, there is a material amount of insurance business carried out in New Zealand by entities that are not licensed insurers. This includes both types of contract currently deemed not to be insurance contracts under IPSA (e.g. warranties, guarantees and waivers) and unlicensed (by the Reserve Bank) foreign insurance firms that insure New Zealand policyholders. Unlicensed insurance activity in New Zealand is a problem because it means consumers are not appropriately protected and competition is not fair. Consumers may also be under the impression they are dealing with a licensed insurer when that is not the case, which can lead to problems should there be an issue with the provider and discover they are not protected by the framing regulating licensed insurers.

We consider that monitoring and compliance of current laws also needs to be stepped up. Mismatches of definitions under New Zealand law that allow entities to undertake unregulated insurance services by calling them something else also need to be removed. It is important for customers to be fully aware of whether they are engaging with an insurer or non-insurer (regardless of name and licensing). To achieve this there is also a need for a more general prohibition on activity and conduct by non-insurers representing themselves to customers as insurers.

Understanding insurance

Industry leadership

Natural disasters.

Media & resources

©Insurance Council of New Zealand | Te Kahui Inihua o Aotearoa Privacy policy